How I Became Passionate About Personal Finance

When I graduated from college in 2012 it was with around $100,000 of student loan debt (whether an 18-year-old should be able to secure that much debt is a subject for another post). The mimimum payment on my loans was $800, my rent was another $800, and my share of utilities was $50. At the time, I was making between $350 and $500 every week (post-tax) waiting tables and bartending. Before other expenses, this typically left me with around $50-$100 every month for everything else – food, laundry, clothes, etc. Needless to say, money was tight.

Must. Track. Everything.

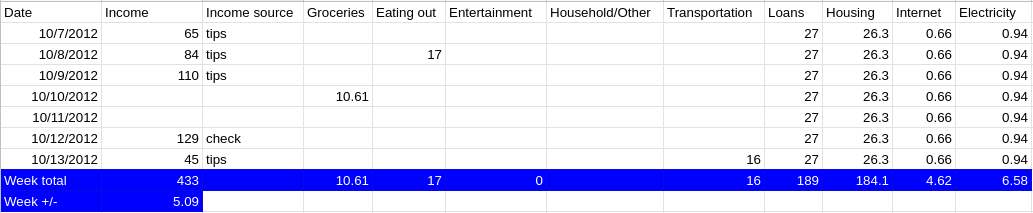

I didn’t know a thing about budgeting, but I knew there was a real risk of not having enough money to go around, so I created a rudimentary spreadsheet to track my weekly income and expenses. The only way I survived that period of my life financially was by tracking every penny I made and allocating it to specific upcoming expenses. Simply trying to be frugal and mindful of spending would not have been enough – even $20 misallocated represented the possibility of defaulting on my loans or not making rent.

This is a real screenshot of the spreadsheet I used during this period of my life:

I was fortunate enough to get a free shift meal at work, so every day I was working I would eat my allotment of grilled chicken tenders and as much rice, beans, and salad as I could. If it weren’t for those free meals, I don’t think I could have made it work. When I wasn’t working, I almost exclusively ate Red Baron pizza, which I could get three of for $10. Each pizza had around 1500 calories, which was usually enough to sustain me for a day.

A Meeting of Happenstance

I was bartending one night when a guy walked in that I had worked with while interning as a business analyst at a mutual fund during college. We talked for a bit and I found out that he had since taken a new role at a financial software company called Fidessa. We exchanged e-mails, I had a few interviews, and three months later I was a Buy-side Production Support Specialist at Fidessa and being paid over twice what I had been making at the restaurant. To say I was relieved would be a massive understatement.

Remember What You Learned

I was making more money, but I had gotten a taste of what it is like to be one unplanned expense from not making rent. I vowed to do everything I could to never come anywhere close to that ever again. In fact, I would do everything I could to get as far away from that as possible. Years later, I still track every penny I make and every penny I spend (though with the help of software and with fancier spreadsheets). As I’ve gotten older, personal finance has become less about ensuring I make rent and more about allocating money to the things that provide me the most value. It is as much about identifying what is important to me as it is about numbers and figures.